When renting a property, deciding how much to charge for rent can be deceptively difficult. Sure, charging more than surrounding properties might pay off if you own the most desirable property in the neighborhood, but this can drive potential tenants away. Remember, while you’re looking to turn the most profit, tenants are looking for the best property, at the best price. The decision to rent out your home is a business decision at its core. As with any business, your pricing strategy affects everything. If it’s priced too low, you’re not getting the maximum ROI, and it can negatively affect the perception of your property to prospective tenants. If it’s priced too high, you run the risk of it sitting vacant for an extended period of time, effectively preventing you from making a profit at all. Finding a balance that’s fair to owners and to tenants may be trying, but there are a few key points to consider that will help you in the right direction. Whether or not you’re working with a property management company, it’s important to know how pricing works so you fully understand what your potential return will be.

Location, location, location.

One of the most important factors to consider is where the property is located. Look at surrounding properties to see what kind of rent they are charging. Try to keep track of which properties in your area are being rented quickly and which are sitting dormant, and try to figure out what differentiates them. Of course, the desirability of a property is affected by its proximity to local amenities, such as schools, transportation, local attractions, and hospitals. The closer a property to these facilities, the more youcan justify adding to a rent. This is one of the key benefits of working with a property management company like Simply Residential Property Management. We know the market and are always up to date on the latest trends in the industry because that’s our job. Our clients don’t worry about all the leg work, we find the information and explain their options to them.

Seeing is believing.

A good view can greatly increase the value of a property. Looking out over a garden or field, a property will feel more enticing to prospective tenants. Meanwhile, a property that faces a parking lot or a highway will sometimes struggle to justify a higher rent.

Extra, extra!

When considering how much to charge for rent, extra storage space, a washer and dryer in the unit, central air conditioning, a fenced in yard, balconies, being pet friendly and off-street parking can all help justify adding a few extra dollars. Prospective tenants will likely have seen several properties, and many will be willing to pay that little bit extra for the added benefits your property has to offer.

Try to find a balance.

If your listing is over 21 days old, despite regular viewings, then it’s time to consider if you have been asking for too much. While it’s tempting to leave a high rent rating on a property in the hope someone will snap it up, tenants are more likely to continue looking than settle for somewhere they feel is overpriced. Likewise, if you set the rent too low just to attract potential tenants, you’ll feel the pinch further down the line when you aren’t experience the greatest possible return. Also, it could negatively alter the perception of your property, or attract tenants that aren’t the best quality. Working with a property management company in this respect is also a huge benefit. They have the resources to do more marketing and thoroughly screen renters before they’re offered a lease.

Know your market.

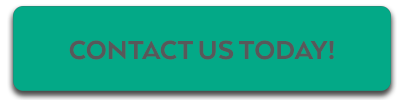

There are very few properties on earth that will stay the same value forever. When you set your rent, remember that this will be liable to change according to the current property demand. If you leave the rent at a higher price during a dip in the market, then your property will be seen as overpriced in comparison to those around it. If you keep your rent at the same price when everyone around you is raising theirs, you could be missing out on the chance to increase your overall yield. There is no such thing as a set-it-and-forget-it rental price.

Remember what’s important.

The most important thing to remember is that each decision you make regarding your property is first and foremost a business decision. Your property is an investment, and so turning a profit is the most important aspect of your role as landlord. Many property owners, especially those with large mortgages or construction loans, do not see an actual profit until they sell their property or until they have owned the property long term. If the property is not helping you pay down your mortgage, reap tax benefits, or if it isn’t putting money directly in your pocket, you need to reassess the amount you charge as a rent or potentially refinance your home. This is yet another instance where working with a property management company is beneficial. Think of that relationship as a business partnership — at Simpy Residential we’re connected to many realtors, financial advisors, insurance agents, and even lawyers. When our clients need advice or help, we have a strong network to refer them to so they know they’re working with someone they can trust.

If you’re sick of self managing, or if your property management company isn’t doing everything they can to increase your ROI, it’s time to think about making a change. It all starts with the basics — understanding what your property is worth and how much a property management contract will cost you over time. If you want to take that first step, get your free rental analysis today!

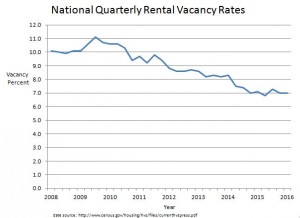

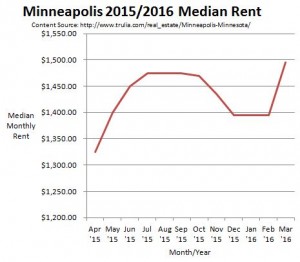

Simply Residential used those statistics to justify recommendations of rental rate increases for a number of our properties during 1Q 2016. Low vacancy rates also mean rentals are on the market for less time. We saw this firsthand last month, as 1/3 of our March new lease signings occurred within a week of being marketed.

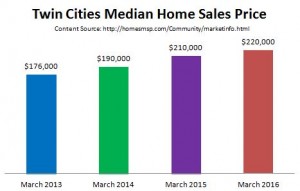

Simply Residential used those statistics to justify recommendations of rental rate increases for a number of our properties during 1Q 2016. Low vacancy rates also mean rentals are on the market for less time. We saw this firsthand last month, as 1/3 of our March new lease signings occurred within a week of being marketed. The multi-colored graph to the right shows how much higher the median sales price was in March 2016 compared to March in previous years. If you’re considering selling your investment property, please speak with us. Along with providing rental property management services, our on-staff licensed real estate agent and broker are happy to provide you a comparable market analysis (CMA) so you can properly consider the options of renting and selling your property. Also, know that we offer special real estate service pricing to our current property management clients.

The multi-colored graph to the right shows how much higher the median sales price was in March 2016 compared to March in previous years. If you’re considering selling your investment property, please speak with us. Along with providing rental property management services, our on-staff licensed real estate agent and broker are happy to provide you a comparable market analysis (CMA) so you can properly consider the options of renting and selling your property. Also, know that we offer special real estate service pricing to our current property management clients.