As first quarter 2016 (Jan, Feb, Mar) came to a close, it was clear that early 2016 has been strong for both landlords and home sellers.

Rental Market

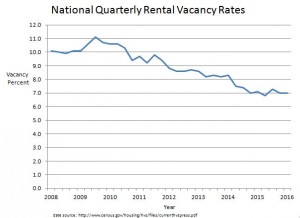

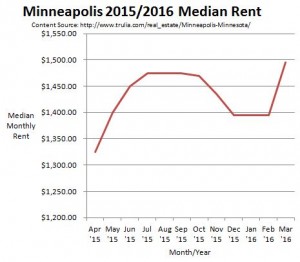

Vacancy rate is the percentage of unoccupied or vacant rentals of the total number of rentals in a designated market. It’s a common metric to measure the strength of the rental market. The U.S. Census Bureau reports that the national rental vacancy rate closed at 7.0% for 1Q 2016. That rate has stayed fairly consistent over the past year, but the blue graph to the right shows how low the monthly vacancy rate is compared to the past seven years. So, what does a low vacancy rate mean for investment property owners? When vacancy rates are low, rent prices rise as tenants scramble to find properties. The red graph to the right shows that March 2016 had the highest median monthly rent in Minneapolis over the past 12 months.  Simply Residential used those statistics to justify recommendations of rental rate increases for a number of our properties during 1Q 2016. Low vacancy rates also mean rentals are on the market for less time. We saw this firsthand last month, as 1/3 of our March new lease signings occurred within a week of being marketed.

Simply Residential used those statistics to justify recommendations of rental rate increases for a number of our properties during 1Q 2016. Low vacancy rates also mean rentals are on the market for less time. We saw this firsthand last month, as 1/3 of our March new lease signings occurred within a week of being marketed.

Real Estate Sales

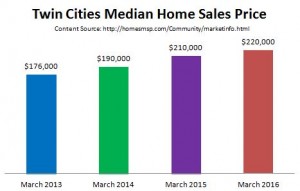

As job and wage growth slowly drive the country’s recovery from the recession, we’re seeing a renewed consumer confidence. Couple the interested buyers with a low inventory of homes for sale and we have a seller’s market. Homesmsp.com reports that there was a 20.6% decrease in Twin Cities homes on the market in March 2016 compared to March of last year.  The multi-colored graph to the right shows how much higher the median sales price was in March 2016 compared to March in previous years. If you’re considering selling your investment property, please speak with us. Along with providing rental property management services, our on-staff licensed real estate agent and broker are happy to provide you a comparable market analysis (CMA) so you can properly consider the options of renting and selling your property. Also, know that we offer special real estate service pricing to our current property management clients.

The multi-colored graph to the right shows how much higher the median sales price was in March 2016 compared to March in previous years. If you’re considering selling your investment property, please speak with us. Along with providing rental property management services, our on-staff licensed real estate agent and broker are happy to provide you a comparable market analysis (CMA) so you can properly consider the options of renting and selling your property. Also, know that we offer special real estate service pricing to our current property management clients.

Conclusion

Whether you’re renting or selling, Simply Residential Property Management’s leasing and sales team has you covered. The first quarter results from 2016 show that both the property rental and home sales markets are very strong. Simply Residential will continue to monitor important factors including the interest rate and the local vacancy rate. But it’s clear that now is a fabulous time to rent out or sell property.