Owning investment rental properties can be trying. It requires patience, research, excellent interpersonal skills and a financial stability that allows for things to, on occasion, go wrong. But if you find yourself successfully balancing all the aspects of being a landlord and want more, then you might want to think about investing in another property. It may be tempting after you’ve already cut your teeth as landlord of the first property, but there are several new things to consider before investing in a second property.

No two properties are ever the same

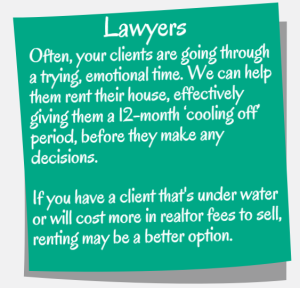

While you might be thinking you have a strong understanding of what being a landlord requires, you have to go into the venture of second properties with your mind open to every possibility. So your first property was a dream; it didn’t require much maintenance, you had model tenants, it was within easy reach of your own property. You need to bear in mind that, while your first property was easy, there is still a chance of your new property causing you problems. Obviously you have a better knowledge of what to look for, and you will be going into the venture with more understanding than a first time landlord, but this is no excuse for leniency. That’s why so many experienced rental property owners choose to utilize the services of a property management company.

Try to remember what caused you the most time, money and effort to correct your first property, and prioritize these aspects in your search for a second property.

Don’t always buy close to your first property

While it may be tempting to purchase that property just down the road from your first, this should not be your number one reason for purchase. Remember, it’s still important to do your research into the current housing situation. If the properties close to your first are not doing well, then it may be worth looking a little further away. While it does mean more time driving, it could actually save you money in the long run. However, that doesn’t mean you shouldn’t look nearby, especially if your first property is a good area. This also helps you get a rough gauge on extras, like the most likely tenant type in that area and possibly housing bills such as heating and electricity.

Markets fluctuate, so can your property value

Although you will be more experienced than a first time landlord, it’s important to remember that there’s no guarantee the experience of buying a second buy-to-rent property will be the same. The housing market can fluctuate dramatically, lowering the value of your properties. With two purchased properties, it can mean losing double the amount of money should housing values drop. Take some time to research the market, and the area you are considering. If a new transit route has been built near the property, this could increase its value over time. Simultaneously, a new building appearing nearby could obscure views from the property and bring its value down.

The most vital aspect to remember when considering the purchase of a second buy-to-rent property is that you already have a strong grasp of the fundamentals, so use this to your advantage. Remember what worked for your first property and avoid making the same mistakes. If you’re unsure, or you don’t want to take on the additional responsibility of managing a second property, it’s wise to consider investing in a property management company to take care of the minutia.